We’re on a mission to transform the lives of people in Derbyshire and Derby City. That means that we help people build financial resilience, have savings, borrow affordably when they need to, be able to make good financial choices. We measure our impact across a range of criteria: age, gender, household deprivation, savings, borrowing, Member satisfaction and reviews.

We are confident that Derbyshire Community Bank has a transformational impact on individuals. We will continue to grow, reaching more people across our region. This is for everyone; by saving together we change the lives of more people in our community.

Many young people face challenges when it comes to managing their finances. Being a Member of DCBank helps them save regularly, build financial resilience, improve their credit score, and access affordable credit when they need to.

At Derbyshire Community Bank, 54% of our members are under 40, and we understand the unique financial pressures they face. Our goal is to provide the support and resources needed to help them achieve financial stability and build a brighter future.

UK postcodes are categorised into 10 Index of Multiple Deprivation (IMD) groups based on an assessment of income, employment, housing quality, education and training, healthcare, local environment ,crime. 1 is most deprived, group 10 is assessed as having the highest facilities and opportunities. Credit unions are for everyone, but as a community-focussed organisation, DCBank’s products are services are particularly valued by those in the lower IMD areas, who may otherwise have limited access to financial services and credit. The majority of our Members live within the most deprived areas of Derby and Derbyshire; we can see that we are reaching those who need us the most.

Women can find it harder to access affordable finance, due to lower and inconsistent incomes and thin credit files. DCBank’s Membership is overwhelming female; a reflection of our inclusion and products that serve their needs.

We understand that people find it hard to save, research suggests that 26% of UK adults have little to no savings. Part of our mission is to help people start a savings habit; to build up their financial resilience for when unexpected bills arrive and cost of living expenses. We know that having a savings pot gives people confidence to make better decisions knowing they aren’t dependent upon debt.

We encourage all our Members to save at least £12/month with DCBank. All our borrowers are now saving £12/month (previously £8). This is only step one; we further want to help our Members save more, to have savings goals so we can all have a more fulfilling life and to create opportunities to flourish. Our savings data demonstrates that our Member average savings steadily increases the longer they are a member with us.

Many Members start their savings journey with a loan from Derbyshire Community Bank; all our borrowers now save at least £12/month alongside their loan repayment; building financial resilience and a savings habit.

Loans range from a few hundred pounds to £7,500, average loan size is currently £500 (including top-up loans). Credit union loan rates are restricted to no more than 3%/month (42.6% APR). We are often cheaper than credit card and overdraft rates. Plus we are significantly better value than sub-prime lenders and illegal lenders (loan sharks). Our Members save thousands in interest that would be charged by other lenders, plus repaying a credit union loan on schedule should positively impact our Members’ credit history.

We encourage our Members to borrow for a specific purpose: to spread the cost of celebrations, holidays, home improvements, car purchase and maintenance, school uniforms and paying the bills and debt consolidation; clearing expensive debts elsewhere.

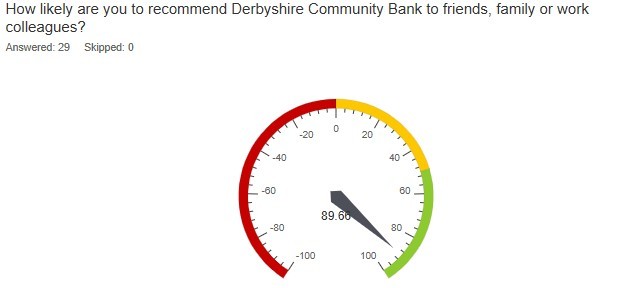

We ask our Members if their loan has improved their life; a loan is intended to take the stress out of expenditure, improve financial control. 96% respond positively, our borrowers report a Net Promoter Score of 89%. Members also report that they spent their loan as intended; not lost in household expenditure – a good indicator of financial control.

The world has moved online, and we understand that some people struggle with that. Managing your finances, accessing healthcare, job opportunities, all require access to the internet and understanding how to use it effectively and safely.

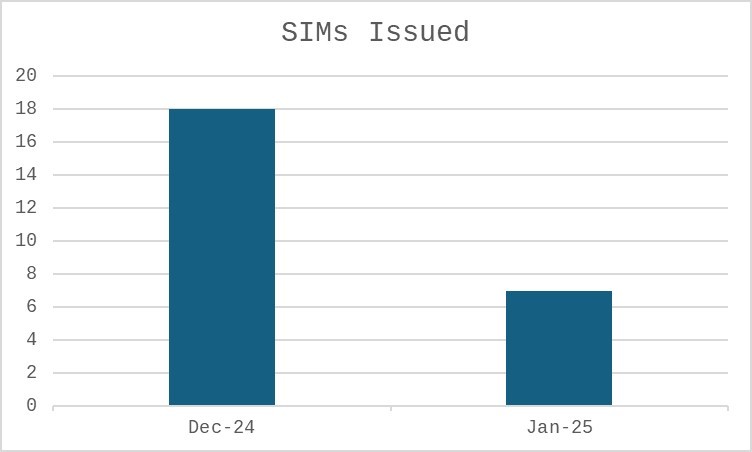

That is why we have partnered with The Good Things Foundation to provide a free SIM card to those who need it. Connecting people with support organisations across Derbyshire and Derby City with Rural Action Derbyshire, we can also enable people with devices and guidance on setting up their new digital connection. Find out more.

Our latest Member satisfaction survey asks about our products and services, technology, customer service, how they feel about our organisation, fundamentally, has being a Member of DCBank improved their life?

The overall customer satisfaction score is 81.74 (benchmark 78), overall average survey rating 8.55/10 and a Net Promoter Score of 77%.

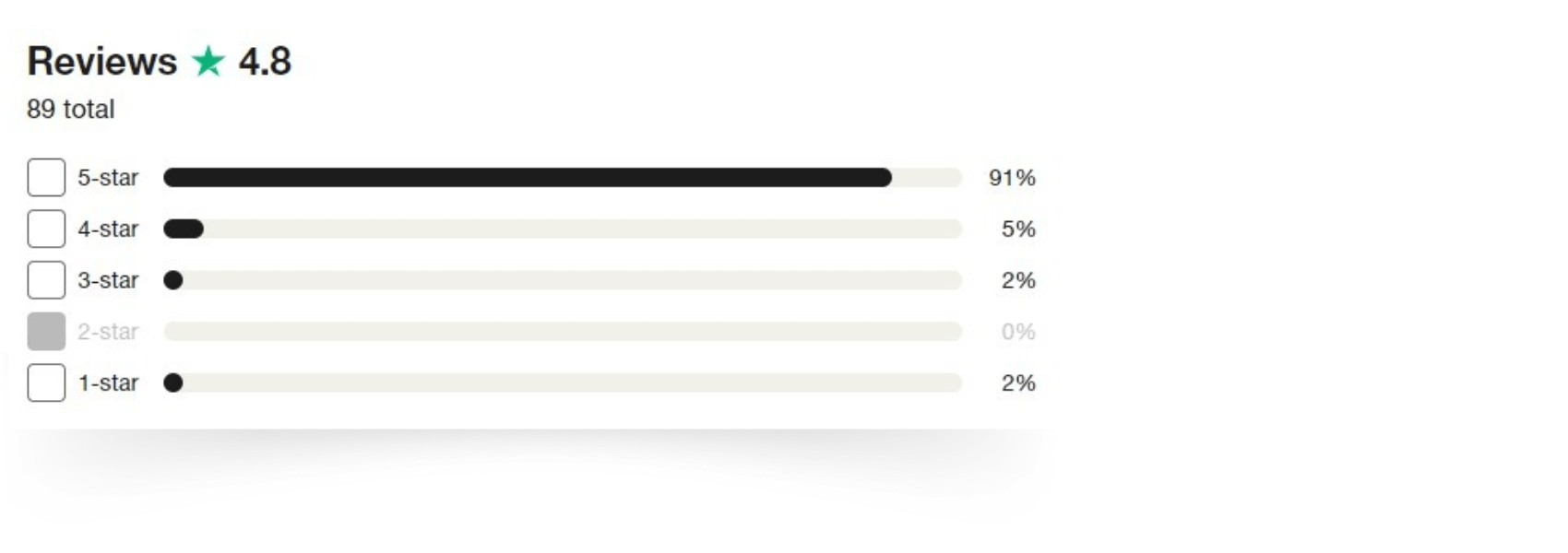

We encourage our Members to share their experience with Google Reviews and TrustPilot. This is what our Members are saying:

DCBank is for everyone, but we can’t do everything. We can only achieve this together, as the communities of Derbyshire and Derby. We are proud of the partnerships we have with a wide range of organisations: councils, businesses, social housing providers, community volunteer services, advice services, charities, faith groups.

Partners work with us in a number of ways:

Payroll Deduction partners – offering a payroll deduction service to employees is an easy way to enable staff to save regularly and borrow affordably.

Angel Savers – we are humbled that so many individuals and organisations deposit significant sums with DCBank, enabling us to lend to people in our community.

Advice and Support Services – we link with many organisations including councils providing advice, support and other services to those in need. When appropriate, they will refer clients to us to ensure they are not financially excluded.

Loan Shark Team – We work with the Illegal Money Lending Team, who are able to investigate and prosecute illegal lenders.

Find out more about our partnerships.